All Categories

Featured

Table of Contents

The method has its own benefits, yet it likewise has issues with high costs, intricacy, and a lot more, resulting in it being considered as a scam by some. Infinite financial is not the most effective policy if you require just the investment part. The boundless banking concept revolves around making use of whole life insurance policy plans as an economic tool.

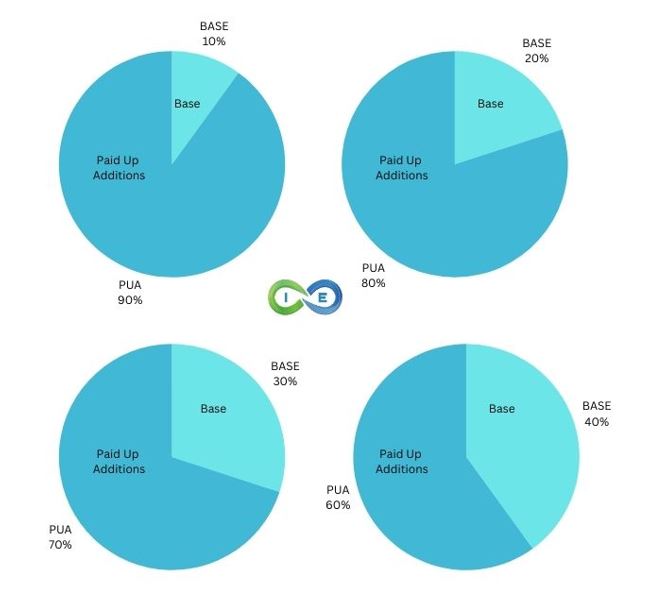

A PUAR allows you to "overfund" your insurance plan right approximately line of it becoming a Modified Endowment Agreement (MEC). When you use a PUAR, you quickly enhance your cash money worth (and your survivor benefit), therefore increasing the power of your "financial institution". Better, the more money worth you have, the better your rate of interest and returns repayments from your insurance firm will be.

With the surge of TikTok as an information-sharing platform, economic recommendations and strategies have discovered a novel means of spreading. One such approach that has been making the rounds is the infinite banking idea, or IBC for brief, garnering recommendations from celebrities like rapper Waka Flocka Flame - Infinite wealth strategy. However, while the approach is currently prominent, its origins map back to the 1980s when economist Nelson Nash presented it to the world.

How flexible is Self-banking System compared to traditional banking?

Within these policies, the money worth grows based upon a price set by the insurance provider. As soon as a considerable money worth accumulates, insurance holders can get a money value finance. These finances vary from conventional ones, with life insurance policy acting as security, suggesting one might shed their insurance coverage if borrowing excessively without appropriate cash money value to sustain the insurance coverage costs.

And while the appeal of these policies appears, there are innate restrictions and dangers, requiring persistent cash worth tracking. The approach's authenticity isn't black and white. For high-net-worth people or service proprietors, particularly those utilizing strategies like company-owned life insurance coverage (COLI), the advantages of tax breaks and compound development could be appealing.

The allure of unlimited financial doesn't negate its challenges: Price: The foundational demand, an irreversible life insurance coverage policy, is costlier than its term equivalents. Eligibility: Not everybody gets whole life insurance policy due to strenuous underwriting processes that can omit those with details health or lifestyle problems. Intricacy and threat: The detailed nature of IBC, combined with its threats, might discourage several, specifically when less complex and much less high-risk choices are readily available.

Whole Life For Infinite Banking

Alloting around 10% of your month-to-month revenue to the plan is simply not feasible for most individuals. Making use of life insurance policy as a financial investment and liquidity resource requires self-control and tracking of policy money value. Seek advice from a monetary advisor to identify if infinite financial lines up with your top priorities. Part of what you read below is merely a reiteration of what has actually currently been said above.

So prior to you get on your own right into a scenario you're not gotten ready for, know the complying with first: Although the principle is typically offered therefore, you're not really taking a financing from yourself. If that held true, you wouldn't have to repay it. Rather, you're obtaining from the insurance policy business and have to repay it with rate of interest.

Some social networks articles advise making use of cash worth from whole life insurance policy to pay for charge card debt. The concept is that when you settle the finance with interest, the quantity will certainly be returned to your financial investments. That's not exactly how it functions. When you pay back the funding, a part of that passion mosts likely to the insurance provider.

What is the minimum commitment for Financial Leverage With Infinite Banking?

For the very first a number of years, you'll be paying off the payment. This makes it very challenging for your policy to gather value during this time. Unless you can manage to pay a few to several hundred dollars for the following years or more, IBC won't function for you.

If you need life insurance coverage, below are some important ideas to consider: Take into consideration term life insurance. Make sure to go shopping about for the finest price.

What is the minimum commitment for Self-financing With Life Insurance?

Imagine never having to fret about bank lendings or high passion rates once again. That's the power of limitless banking life insurance policy.

There's no set loan term, and you have the freedom to select the repayment routine, which can be as leisurely as paying off the car loan at the time of fatality. This flexibility extends to the maintenance of the financings, where you can go with interest-only payments, keeping the car loan balance flat and convenient.

Can anyone benefit from Infinite Banking?

Holding cash in an IUL taken care of account being credited interest can typically be much better than holding the cash money on down payment at a bank.: You have actually always desired for opening your very own bakeshop. You can borrow from your IUL plan to cover the initial expenses of leasing an area, purchasing devices, and hiring personnel.

Personal financings can be gotten from traditional banks and credit score unions. Borrowing cash on a credit report card is normally very pricey with yearly percentage rates of interest (APR) commonly getting to 20% to 30% or more a year.

Table of Contents

Latest Posts

Byob

Infinite Concepts Scam

How To Create Your Own Banking System

More

Latest Posts

Byob

Infinite Concepts Scam

How To Create Your Own Banking System