All Categories

Featured

Table of Contents

- – What are the risks of using Infinite Banking F...

- – What are the benefits of using Bank On Yoursel...

- – How does Infinite Banking Wealth Strategy com...

- – What is the minimum commitment for Infinite B...

- – How do interest rates affect Bank On Yourself?

- – How do I qualify for Financial Independence ...

- – What is the long-term impact of Cash Value L...

Term life is the perfect option to a momentary requirement for shielding versus the loss of a breadwinner. There are far less factors for permanent life insurance policy. Key-man insurance coverage and as part of a buy-sell contract come to mind as a possible excellent reason to purchase a permanent life insurance coverage plan.

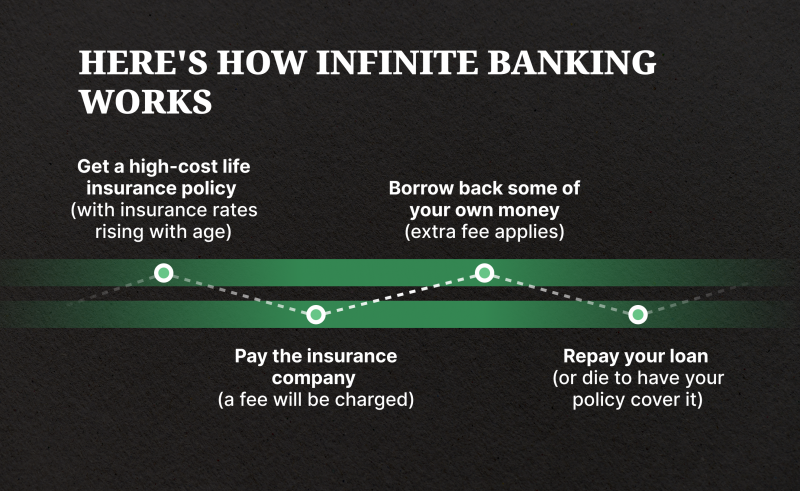

It is a fancy term coined to market high priced life insurance policy with sufficient payments to the agent and substantial earnings to the insurance coverage firms. Cash flow banking. You can get to the same end result as infinite financial with much better outcomes, more liquidity, no danger of a plan lapse activating a huge tax issue and more choices if you use my alternatives

What are the risks of using Infinite Banking For Retirement?

Compare that to the biases the promoters of infinity financial obtain. 5 Blunders Individuals Make With Infinite Banking.

As you approach your golden years, monetary security is a top priority. Among the lots of various financial methods out there, you might be listening to even more and a lot more concerning infinite banking. Borrowing against cash value. This principle enables nearly any person to become their own lenders, offering some benefits and versatility that might fit well right into your retired life strategy

What are the benefits of using Bank On Yourself for personal financing?

The lending will certainly accumulate straightforward rate of interest, yet you keep adaptability in setting repayment terms. The rate of interest is additionally commonly reduced than what you 'd pay a typical bank. This sort of withdrawal allows you to access a section of your cash worth (up to the quantity you've paid in costs) tax-free.

Many pre-retirees have worries regarding the safety and security of unlimited financial, and for excellent factor. While it is a legit strategy that's been taken on by people and services for several years, there are risks and drawbacks to take into consideration. Boundless banking is not a guaranteed method to accumulate wide range. The returns on the cash money worth of the insurance plans may rise and fall relying on what the market is doing.

How does Infinite Banking Wealth Strategy compare to traditional investment strategies?

Infinite Financial is a financial strategy that has actually acquired significant focus over the previous few years. It's a distinct approach to managing individual finances, enabling individuals to take control of their money and produce a self-sufficient financial system - Policy loans. Infinite Banking, likewise referred to as the Infinite Financial Principle (IBC) or the Count on Yourself strategy, is a monetary strategy that includes utilizing dividend-paying entire life insurance policy plans to produce a personal financial system

To recognize the Infinite Financial. Principle approach, it is consequently important to provide a review on life insurance policy as it is an extremely misconstrued possession course. Life insurance policy is a crucial part of financial preparation that gives numerous benefits. It comes in lots of shapes and dimensions, the most typical types being term life, entire life, and global life insurance policy.

What is the minimum commitment for Infinite Banking For Retirement?

Let's discover what each type is and exactly how they differ. Term life insurance policy, as its name suggests, covers a particular duration or term, commonly in between 10 to 30 years. It is the easiest and typically the most economical kind of life insurance policy. If the insurance holder passes away within the term, the insurance firm will certainly pay the death advantage to the marked beneficiaries.

Some term life plans can be restored or transformed into a permanent plan at the end of the term, but the premiums generally boost upon renewal as a result of age. Entire life insurance policy is a sort of permanent life insurance policy that gives insurance coverage for the policyholder's entire life. Unlike term life insurance policy, it includes a cash worth part that grows over time on a tax-deferred basis.

It's vital to bear in mind that any exceptional lendings taken against the plan will certainly lower the fatality advantage. Whole life insurance policy is usually much more costly than term insurance due to the fact that it lasts a lifetime and builds money worth. It also uses foreseeable costs, implying the cost will not boost over time, giving a level of assurance for insurance policy holders.

How do interest rates affect Bank On Yourself?

Some reasons for the misunderstandings are: Complexity: Whole life insurance policy plans have much more intricate features compared to label life insurance, such as cash money worth buildup, dividends, and policy fundings. These functions can be testing to recognize for those without a background in insurance policy or individual money, bring about confusion and misconceptions.

Prejudice and misinformation: Some individuals might have had negative experiences with entire life insurance policy or listened to tales from others who have. These experiences and unscientific details can add to a prejudiced view of entire life insurance policy and continue misunderstandings. The Infinite Financial Idea method can only be implemented and executed with a dividend-paying entire life insurance policy with a common insurance provider.

Whole life insurance coverage is a sort of permanent life insurance policy that offers insurance coverage for the insured's entire life as long as the costs are paid. Entire life plans have 2 primary components: a survivor benefit and a money value (Self-banking system). The death benefit is the quantity paid out to recipients upon the insured's fatality, while the money worth is a financial savings component that grows over time

How do I qualify for Financial Independence Through Infinite Banking?

Dividend repayments: Common insurance policy firms are possessed by their insurance policy holders, and consequently, they may disperse profits to policyholders in the form of returns. While returns are not assured, they can assist improve the money worth growth of your policy, enhancing the overall return on your funding. Tax benefits: The cash worth development within an entire life insurance policy plan is tax-deferred, suggesting you don't pay tax obligations on the development till you take out the funds.

Liquidity: The cash money value of a whole life insurance policy is extremely fluid, permitting you to gain access to funds quickly when required. Asset defense: In several states, the cash money worth of a life insurance plan is protected from creditors and claims.

What is the long-term impact of Cash Value Leveraging on my financial plan?

The plan will certainly have instant cash worth that can be put as collateral 1 month after funding the life insurance plan for a rotating credit line. You will have the ability to gain access to through the rotating credit line approximately 95% of the available money worth and make use of the liquidity to fund a financial investment that offers revenue (capital), tax benefits, the chance for recognition and leverage of other people's capability, capacities, networks, and funding.

Infinite Financial has actually become very preferred in the insurance coverage globe - also much more so over the last 5 years. R. Nelson Nash was the developer of Infinite Financial and the company he started, The Nelson Nash Institute, is the only company that officially authorizes insurance policy agents as "," based on the following standards: They align with the NNI requirements of professionalism and ethics (Infinite Banking retirement strategy).

They successfully finish an apprenticeship with a senior Licensed IBC Specialist to guarantee their understanding and ability to apply all of the above. StackedLife is Accredited IBC in the San Francisco Bay Location and works nation-wide, aiding customers understand and execute The IBC.

Table of Contents

- – What are the risks of using Infinite Banking F...

- – What are the benefits of using Bank On Yoursel...

- – How does Infinite Banking Wealth Strategy com...

- – What is the minimum commitment for Infinite B...

- – How do interest rates affect Bank On Yourself?

- – How do I qualify for Financial Independence ...

- – What is the long-term impact of Cash Value L...

Latest Posts

Byob

Infinite Concepts Scam

How To Create Your Own Banking System

More

Latest Posts

Byob

Infinite Concepts Scam

How To Create Your Own Banking System